"We make a living by what we get,

we make a life by what we give."

AMFI-registered Mutual Fund Distributor

"We make a living by what we get,

we make a life by what we give."

AMFI-registered Mutual Fund Distributor

Things you always wanted to know about asset allocation

Imagine that you have a pizza in front of you. But the pizza has six different types of toppings with different crusts. Would not that be awesome?

Now think that the pizza is your investment portfolio with different assets. This is called asset allocation, which describes where you have put your money. Although there is a high probability that you will like all the different pizza slices, in case of investment, you need to be sure about where you have put your money and in what proportion. We don’t want you to invest blindly in different assets just because your colleague suggested you.

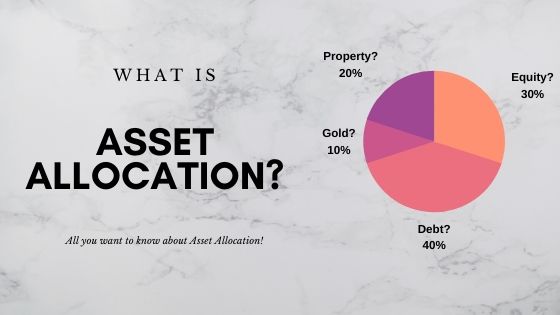

Asset allocation is essential as it helps to reduce the risks associated with an investment option through diversification. Different asset classes such as equities, debt or commodities react differently to a particular event. While one asset may outperform during a specific time frame, other assets may underperform.

Here are some of the questions that you need to ask yourself to come to the right asset allocation.

When are going to need the money?

This question will determine which asset class you should put in money. If you are likely to need the money within 2 to 3 years, you can invest in conservative investment options such as debt mutual funds. It will be better to stay away from equities as the equity market can be volatile in the short run. But it has been historically seen that equity markets give attractive returns in the long term. Hence, if you won’t need this money for five years or more, investing a higher proportion in equities would be the right approach.

What are your financial goals?

In addition to your timeline, your financial goals are also essential to determine your ideal asset allocation. For your short term financial goals, debt mutual funds such as liquid funds, ultra-short term and short term fund are good investment options. Invest in pure equity funds for your long term financial goals.

How much risk can you take?

What will be your reaction if your investment value drops by 15% in a single day? If you are okay seeing your portfolio swing from one extreme to another, you can digest volatility; equities will be a better investment option. However, you can minimise the risks associated with equities by taking the mutual fund approach. High-risk investment options have the potential to give higher returns.

Now, that you have answered the questions, you begin thinking about allocating your money among the different asset classes. According to a thumb rule, your equity allocation should be 100 minus your age. E.g., if you are 25, 75% of your portfolio should be in equities. The younger you are, the higher should be your equity proportion. As you grow older, you can add more debt instruments or cut your equity proportion. It is because as you get older, your risk taking capacity also decreases.

It is also important to keep a specific proportion of your investment proportion (at least three months) as liquid cash for emergency purposes.

These were a few basics of asset allocation. But asset allocation does not stop with equity, debt or cash. Sophisticated or seasoned investors can include alternative investment funds in their portfolio. It is becoming a popular asset class among HNI and UHNIs. It has the potential to deliver higher risk-adjusted returns. Alternative investment funds include start-ups, private companies and hedge funds among others.

Among precious metals, gold is used as a hedging instrument. Gold performs better when the equity markets are in red. Geopolitical tensions and continuous rupee depreciation has made gold one of the must-haves in the investment portfolio of HNIs. However, ideally, gold should not constitute more than 5% of the investment portfolio.

Real estate is another asset that investors can look at to diversify their portfolio. Besides investing in real estate, investors can now invest in real estate investment trust(REIT). Through REITs, investors can invest in high-end commercial real estate.

Conclusion: Coming up with the optimal asset allocation may not be an easy task as there are various factors at play. Prudent asset allocation can help you to achieve your financial goals, fetch maximum returns, minimise risks and have sufficient liquidity. If you not sure where to begin or need further clarity, your financial advisor will be able to help you out.

© 2020 Ventura Suceder. All rights reserved.